Delving into the realm of DigiLife Technology Trends in Fintech Innovation, this article aims to shed light on the latest developments shaping the intersection of technology and financial services.

As we navigate through the various aspects of this dynamic field, we uncover key trends, challenges, and opportunities that define the landscape of Fintech innovation within DigiLife Technology.

Overview of DigiLife Technology Trends in Fintech Innovation

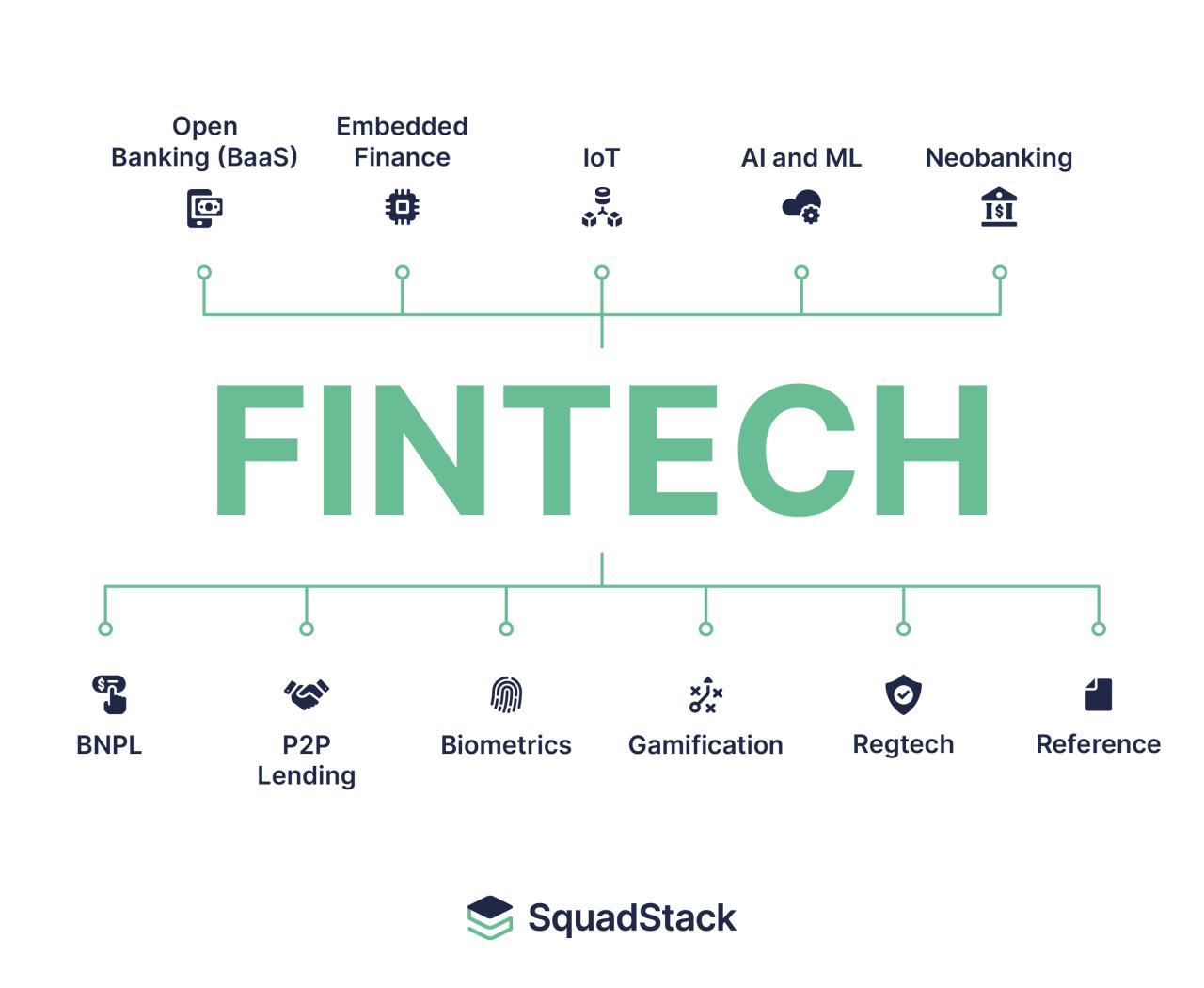

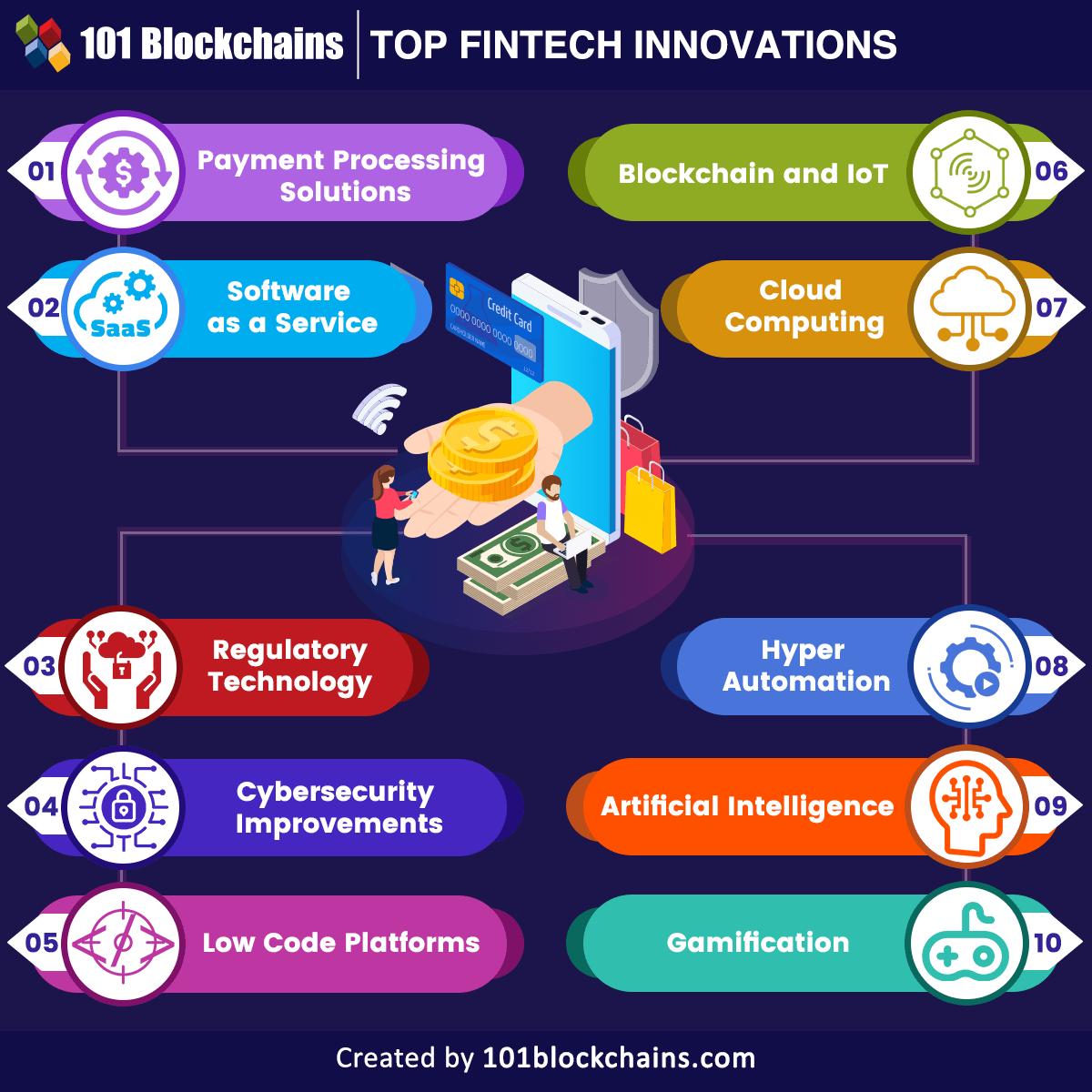

DigiLife Technology refers to the integration of digital technologies into financial services to enhance efficiency, accessibility, and user experience. In the context of Fintech, DigiLife encompasses the use of technologies such as artificial intelligence, blockchain, big data analytics, and mobile applications to revolutionize financial services.

Significance of Integrating Technology with Financial Services

The integration of technology with financial services has significantly transformed the way individuals and businesses manage their finances. It has enabled faster transactions, improved security measures, and enhanced customer experiences. By leveraging technology, financial institutions can streamline operations, reduce costs, and provide innovative solutions to meet the evolving needs of consumers.

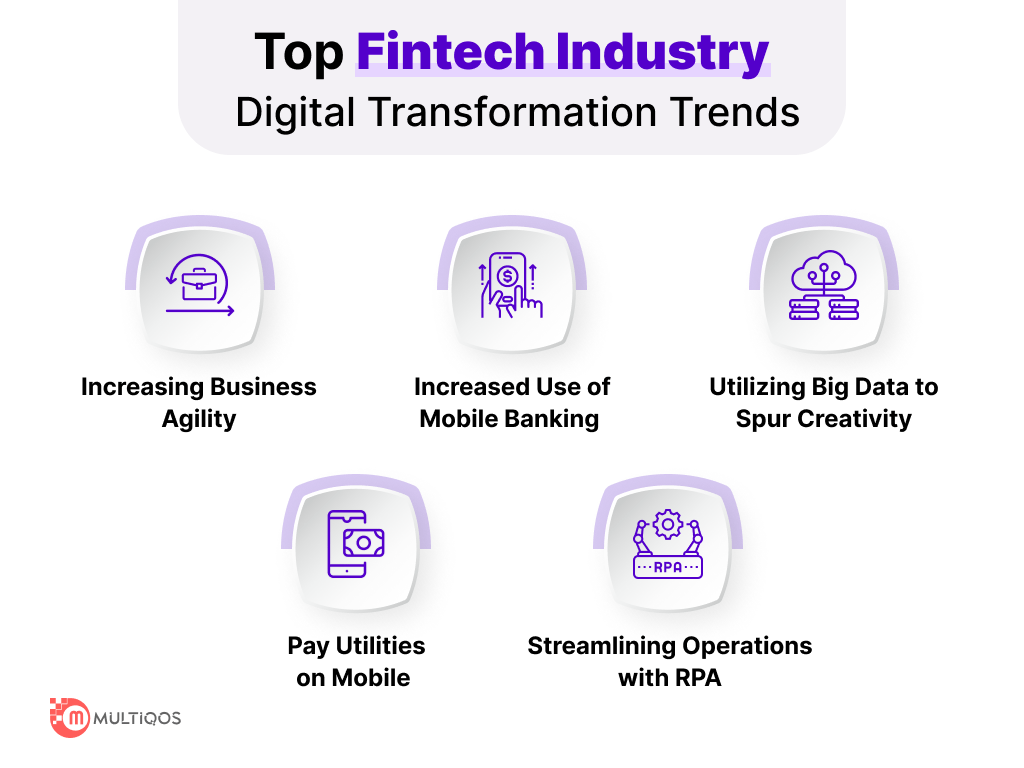

Key Trends Shaping Fintech Innovation within DigiLife Technology

- Rise of Digital Payments: The shift towards cashless transactions and the increasing popularity of mobile payment apps have revolutionized the way people make payments, leading to a cashless economy.

- Blockchain Technology: The adoption of blockchain technology in financial services has facilitated secure and transparent transactions, reducing the need for intermediaries and enhancing trust among parties.

- Artificial Intelligence and Machine Learning: The use of AI and ML algorithms in Fintech has enabled personalized financial services, fraud detection, and risk management, providing more tailored solutions to customers.

- Robo-Advisors: Automated investment platforms powered by AI algorithms have gained popularity, offering users personalized investment advice and portfolio management at lower costs compared to traditional financial advisors.

- Regulatory Technology (Regtech): The implementation of Regtech solutions has simplified compliance processes for financial institutions, ensuring adherence to regulatory requirements and enhancing transparency in the sector.

Impact of Artificial Intelligence in Fintech Innovation

Artificial Intelligence (AI) is playing a transformative role in the Fintech sector within DigiLife Technology, revolutionizing the way financial services are delivered and consumed.

AI Applications in Fintech

- Fraud Detection:AI algorithms can analyze vast amounts of data in real-time to detect patterns indicative of fraudulent activities, helping Fintech companies enhance security measures and protect customer assets.

- Customer Service:AI-powered chatbots and virtual assistants are being utilized to provide personalized customer support, streamline query resolutions, and improve overall user experience in Fintech platforms.

- Investment Advisory:AI algorithms can analyze market trends, risk factors, and individual investor profiles to offer tailored investment recommendations, assisting users in making informed financial decisions.

Challenges and Opportunities

- Challenges:Fintech companies integrating AI technologies face challenges related to data privacy, regulatory compliance, and algorithm bias, requiring robust frameworks and ethical guidelines to mitigate risks.

- Opportunities:AI presents opportunities for Fintech companies to optimize operational efficiencies, develop innovative financial products, and gain competitive advantages by leveraging cutting-edge technology to meet evolving consumer demands.

Blockchain Technology’s Role in Fintech Advancements

Blockchain technology plays a crucial role in advancing fintech services within DigiLife Technology. It revolutionizes financial transactions by providing a decentralized and secure platform for conducting various operations.

Enhanced Security and Transparency

- Blockchain ensures secure transactions by creating a tamper-proof digital ledger that records every transaction in a transparent and immutable manner.

- Smart contracts, powered by blockchain, enable automated and secure agreements between parties without the need for intermediaries, reducing fraud risks.

- Enhanced transparency is achieved as every transaction is traceable, providing a clear audit trail for regulators and users.

Efficiency in Operations

- Blockchain technology streamlines processes by enabling real-time settlement of transactions, reducing the time and cost associated with traditional banking systems.

- Cross-border transactions are expedited through blockchain, eliminating the need for multiple intermediaries and reducing delays in fund transfers.

- The use of blockchain in KYC (Know Your Customer) processes enhances customer onboarding experiences by securely verifying identities and reducing paperwork.

Comparison with Traditional Banking Systems

- Traditional banking systems rely on centralized databases, which are vulnerable to cyber attacks and data breaches, unlike blockchain's decentralized structure.

- Blockchain enhances security by encrypting data and distributing it across a network of nodes, making it challenging for hackers to compromise the system.

- Transaction fees are significantly reduced with blockchain technology, as it eliminates the need for third-party intermediaries, lowering operational costs for financial institutions.

Data Analytics and Personalized Financial Services

Data analytics plays a crucial role in tailoring personalized financial products for DigiLife consumers. By analyzing vast amounts of data, financial institutions can understand the unique needs and preferences of each customer, allowing them to offer customized services that meet individual requirements.

Reshaping Customer Experiences in Fintech

Data-driven strategies are reshaping customer experiences in Fintech by enabling companies to deliver personalized services efficiently. Through advanced analytics techniques, Fintech firms can offer tailored recommendations, predictive insights, and real-time support to enhance the overall customer journey.

Ethical Considerations in Personalized Financial Services

When it comes to using consumer data for personalized financial services, ethical considerations are paramount. Financial institutions must prioritize data privacy, transparency, and security to ensure that customer information is handled responsibly. Respecting customer consent, providing clear opt-in options, and maintaining data accuracy are key principles in delivering personalized financial services ethically.

Summary

In conclusion, the exploration of DigiLife Technology Trends in Fintech Innovation highlights the transformative power of technology in revolutionizing the way financial services are delivered and experienced. As the industry continues to evolve, embracing these trends is essential for staying ahead in the rapidly changing world of Fintech.